Introduction

Last week I had a meeting with a new client, he is extremely astute and understood the economics of South Africa as well as investments offshore. His concerns though arose from the currency devaluation of the South African Rand to the dollar and how much it depreciates any South African Equity Portfolio when compared to its dollar-denominated US Equity counterpart. This scenario is not unique to him but resonates with many investors in South Africa. After my discussion with him, I thought that its relevant to do some research and explore the dynamics of Rand devaluation, its impact on investment portfolios, and present some strategic ways to navigate this financial landscape.

The History of the South African Rand’s Devaluation

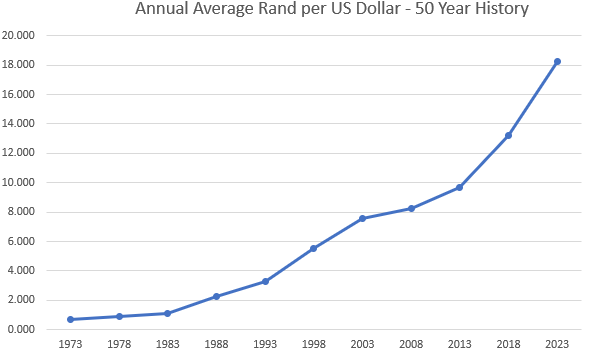

The South African Rand (ZAR) has experienced significant devaluation over the past five decades. This trend is evident when observing the historical USD/ZAR exchange rate:

SA Rand vs US Dollar – 5 Year Intervals – Source: SA Reserve Bank

Upward trend graph, indicating a gradual decrease in the Rand’s value against the US Dollar.

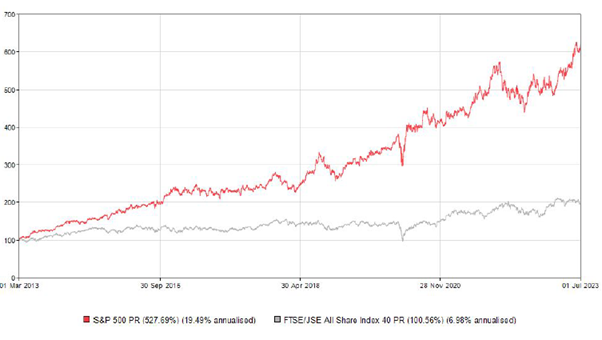

10 Year Comparison of S&P 500 and FTSE/JSE All Share Index 40

If one couples the currency devaluation of the Rand with a performance of South African equities over the past 10 years, the real value of the portfolio when compared to that of a US Dollar denominated Offshore Equity solution is not ideal.

Impact on South African Equity Portfolios

The continuous depreciation of the Rand significantly affects South African Equity Portfolios. It’s an issue that influences not only individual investors but also impacts the broader financial markets.

- Depreciation Effect on Returns: When the Rand devalues against the Dollar, the value of Rand-denominated assets in international terms diminishes. This depreciation translates to lower returns when converted to foreign currencies like the USD.

- Inflation and Purchasing Power: Devaluation can lead to inflationary pressures in South Africa, eroding the real value of returns. This inflation can diminish the purchasing power of investment returns.

- Investment Decisions and Risk Assessment: Currency risks add a layer of complexity to investment decisions. The fluctuation of the Rand can influence both short-term and long-term investment strategies.

Comparative Analysis: Rand vs. Dollar-Denominated Equity Portfolios

The client’s concerns regarding the depreciation of South African Equity Portfolios in comparison to Dollar-denominated US Equity counterparts are legitimate.

- Stability: US Dollar-denominated portfolios often provide more stability in a global context. The US Dollar is viewed as a reserve currency and has historically maintained value better during global economic turbulence.

- Growth Potential: While South African equities offer opportunities for growth, the fluctuating Rand can erode these gains when valued in US Dollars.

- Diversification and Global Exposure: Investing in a US Dollar-denominated Equity portfolio offers exposure to international markets, potentially providing additional diversification benefits.

Strategies for Navigating Currency Devaluation

As a Certified Financial Planner®, I have found the following strategies to be effective for clients concerned about Rand devaluation:

- Diversification: Investing in a mix of Rand and Dollar-denominated assets can reduce exposure to currency risk.

- Hedging: Utilising financial instruments that offset currency risk, such as currency futures or options, can protect against unwanted fluctuations.

- Understanding and Monitoring Economic Factors: Stay informed about the economic conditions affecting currency rates, including interest rates, inflation, and political stability.

- Consulting Professional Advice: Engaging with financial experts and portfolio managers who understand the complexities of currency risk can guide tailored investment strategies.

Conclusion

The devaluation of the South African Rand is a multifaceted challenge that influences investment decisions, particularly when comparing Rand and Dollar-denominated equity portfolios. Understanding these dynamics and employing strategic financial planning can enable investors to navigate these challenges more effectively.

For individuals and investors like my insightful client, recognising the broader context and applying specific strategies may help in achieving investment goals despite the fluctuating currency landscape. Partnering with financial professionals who are equipped to navigate this terrain can be an essential step towards financial stability and growth.

-TN